As we at Zero Limits Ventures endeavor to help companies maximize valuation, we have found one factor that has a, perhaps unexpectedly, most significant positive impact, regardless of industry, market, product or service. The increase in value returns for ‘Firms of Endearment’ (“Firms of Endearment: How World-Class Companies Profit from Passion and Purpose” by David Wolfe) are orders of magnitude greater for all stakeholders; investors, executives, employees and customers, than for other companies.

“We believe that companies with sustainable business practices are better managed, more innovative, less risky and better positioned to deliver superior performance over the long-term.” (Goldman Sachs, GS Sustain)

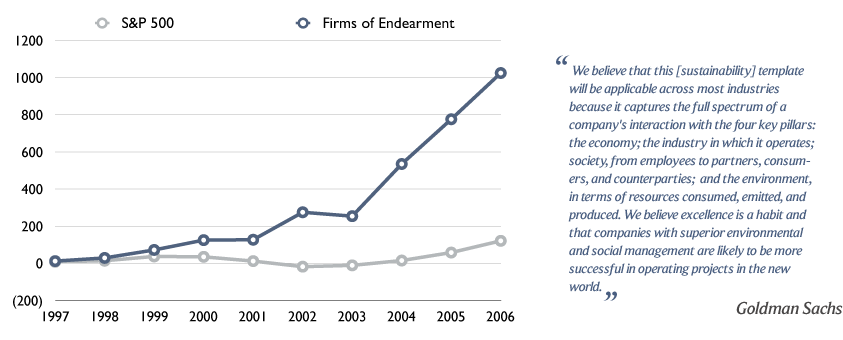

There is a great deal of support, both in theory and in practice, for the integration of sustainability factors into investment analysis and decision-making. Recently, Goldman Sachs, through their GS Sustain effort, began integrating a sustainability framework within their equity research. Additionally, “Firms of Endearment”, defined as those companies that explicitly take a stakeholder-centric approach, returned 1,025 percent over a 10-year period, compared to 122 percent for the S&P 500 during the same period.

Find a cause. Commit to align your company with it. Do great by doing good.

Steve